Minor to Major Account Application Letter in 2023 – To apply for a minor to major account, you will typically need to provide certain details. These may include personal information such as your full name, date of birth, and contact details. You might also be required to submit proof of identification, such as a valid passport or driver’s license. Additionally, you may need to Minor to Major Account Application Letter provide documentation related to your minor account, such as account statements or transaction history. Depending on the institution, you might be asked to fill out an application form or provide information online. It’s essential to review the specific requirements of the financial institution where you wish to apply to ensure you provide all the necessary details.

ALSO READ – Pradhan Mantri Kaushal Vikas Yojana 2023

Minor to Major Account Age limit

The account age limit for upgrading from a minor to a major account is typically 18 years old. This age requirement ensures that individuals have reached the legal age of majority in most jurisdictions. However, some Minor to Major Account Application Letter financial institutions may have their own policies and may require individuals to be at least 21 years old or have additional criteria. It’s important to check with the specific institution for their account age limit and any other requirements for upgrading from a minor to a major account.

Minor to Major account Instruction

To convert a minor account to a major account, follow these step-by-step instructions:

- Gather all necessary documentation, such as identification documents and proof of age.

- Visit your bank or financial institution where the minor account is held.

- Request the necessary forms to convert the account from a minor to a major account.

- Fill out the forms with accurate and up-to-date information.

- Provide any additional documents required by the bank, such as Minor to Major Account Application Letter proof of address or income verification.

- Review the completed forms and ensure all information is correct.

- Submit the forms and supporting documents to the bank representative.

- Wait for the bank to process the request, which may take a few business days.

- Once the conversion is complete, verify the account details and ensure that all restrictions associated with the minor account have been removed.

- Begin using the major account for your banking needs, including deposits, withdrawals, and any other financial transactions.

Remember to consult with your specific bank or financial institution for their specific Minor to Major Account Application Letter requirements and processes to convert a minor account to a major account, as they may vary.

Minor to Major Account Links

Minor to major account links play a pivotal role in the financial landscape, allowing a seamless transition as individuals come of age. These links facilitate a smooth conversion of minor accounts, often Minor to Major Account controlled by guardians, into full-fledged major accounts with expanded privileges and responsibilities. Such a transition empowers young individuals to manage their finances effectively, promoting financial education and independence.

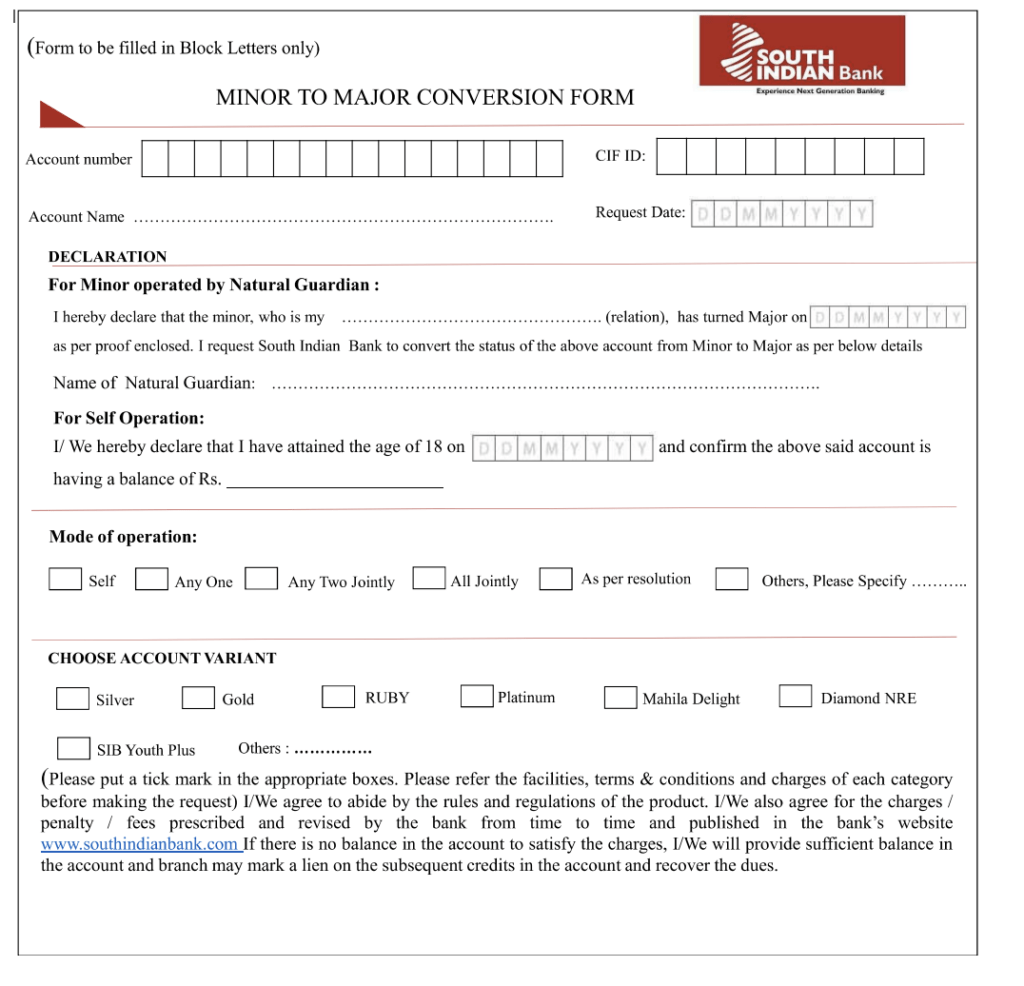

| 1 | Minor to Major Conversion Form | Click Here |

| 2 | Account Opening Form | Click Here |

| 3 | Minor Attaining Majority – Request Form | Click Here |

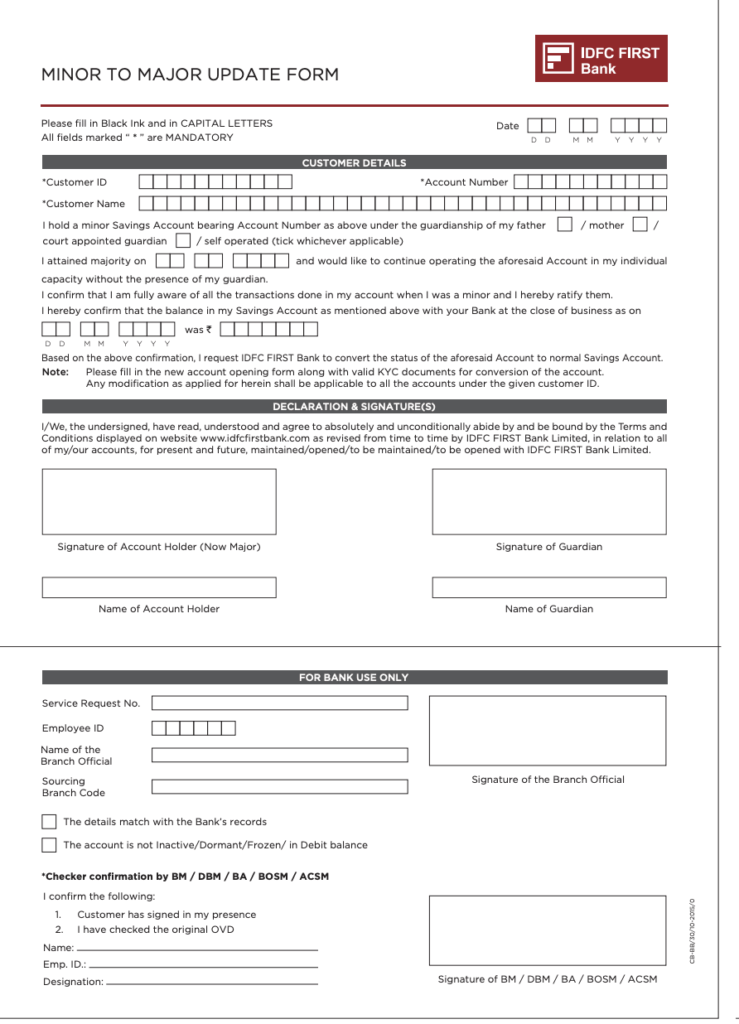

| 4 | MINOR TO MAJOR UPDATE FORM IDFC Bank | Click Here |

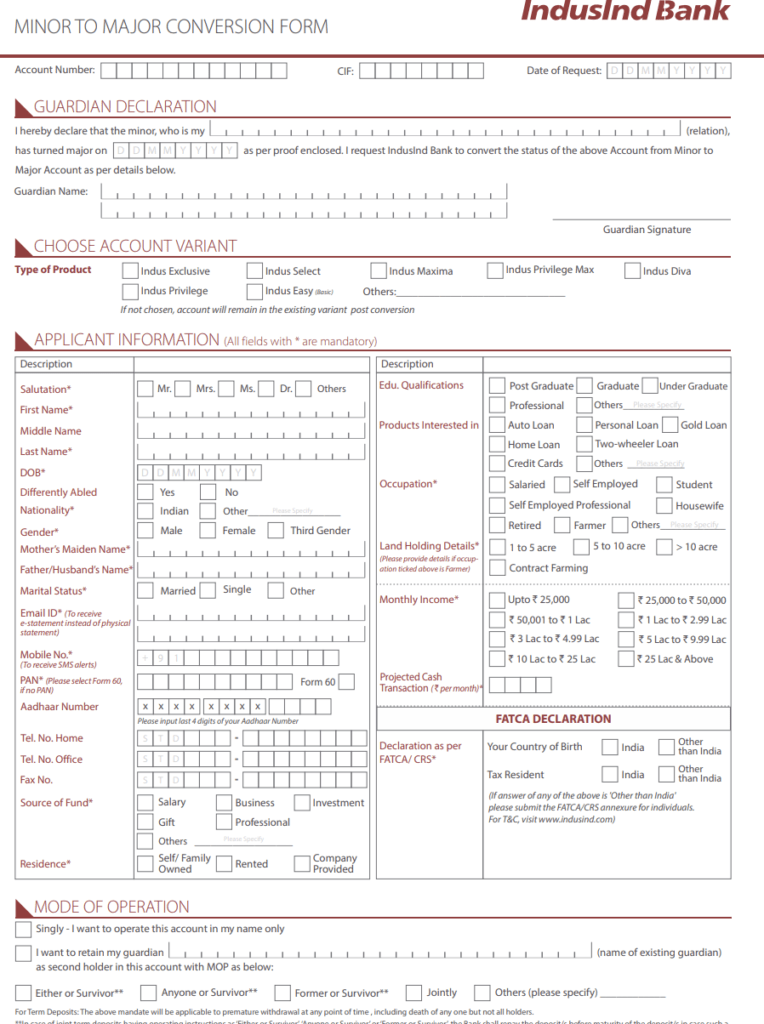

| 5 | Minor to Major Conversion Form Indusind Bank | Click Here |

| 6 | Axis Bank Account Opening Forms Online | Click Here |

| 7 | Union Bank Savings Bank Account for Students(SBZER) | Click Here |

Minor to Major Account Application Letter in English

Dear Sir/Madam,

I am writing to request the upgrade of my minor account to a major account. As a responsible individual, I have reached the age of majority and would like to take full control of my financial affairs. Upgrading my account would provide me with additional benefits, such as increased withdrawal limits, access to investment options, and the ability to manage my finances Minor to Major Account Application Letter independently. I have been a loyal customer of your bank for several years, and I trust in your commitment to providing excellent service. I have attached the necessary documentation, including proof of identity and age, for your review. I kindly request your prompt consideration of my application. Thank you for your attention to this matter.

Yours sincerely, [Your Name]

Minor to Major Account Application Letter in Bengali

প্রিয় [কোম্পানীর নাম],

আমি একটি ছোট অ্যাকাউন্ট থেকে একটি বড় অ্যাকাউন্টে পদোন্নতির জন্য আবেদন করতে লিখছি। আমি ছোটখাট Minor to Major Account Application Letter অ্যাকাউন্ট পরিচালনার ক্ষেত্রে মূল্যবান অভিজ্ঞতা অর্জন করেছি এবং ধারাবাহিকভাবে বিক্রয় লক্ষ্যমাত্রা অতিক্রম করেছি। আমার দৃঢ় যোগাযোগ এবং আলোচনার দক্ষতার সাথে, আমি সফলভাবে প্রধান অ্যাকাউন্টগুলি পরিচালনা করতে এবং আপনার সংস্থার বৃদ্ধিতে অবদান রাখতে আমার ক্ষমতার বিষয়ে আত্মবিশ্বাসী।

আমার আবেদন বিবেচনা করার জন্য আপনাকে ধন্যবাদ.

আন্তরিকভাবে,

[তোমার নাম]

Minor to Major Account Application Letter in Hindi

प्रिय [कंपनी का नाम],

मैं अपने खाते को छोटे से बड़े खाते में अपग्रेड करने में अपनी रुचि व्यक्त करने के लिए लिख रहा हूं। एक दीर्घकालिक ग्राहक के रूप में, मैं आपकी सेवाओं की गुणवत्ता और प्रमुख खाताधारकों को दिए जाने वाले लाभों से प्रभावित हुआ हूँ। मेरे खाते को अपग्रेड करने से मुझे अतिरिक्त सुविधाओं और समर्थन तक पहुंचने में मदद मिलेगी, जिससे मैं आपकी सेवाओं का अधिकतम लाभ उठा सकूंगा। मेरा मानना है कि मैंने एक ग्राहक के रूप में अपनी प्रतिबद्धता और विश्वसनीयता प्रदर्शित की है, और मैं इस खाते के उन्नयन के लिए आपसे अनुरोध करता हूं।

आपके ध्यान देने के लिए धन्यवाद!

ईमानदारी से,

[अप का नाम]

Minor to Major Account Application Letter in Tamil

[உங்கள் பெயர்][உங்கள் முகவரி]

[நகரம் (): மாநிலம் (): தொடர்பாடல் குறியீடு]

[மின்னஞ்சல் முகவரி]

[தொலைபேசி எண்]

[தேதி][பெறுநரின் பெயர்]

[பெறுநரின் நிலை]

[நிறுவனத்தின் பெயர்]

[நிறுவனத்தின் முகவரி]

[நகரம் (): மாநிலம் (): தொடர்பாடல் குறியீடு]

அன்புள்ள [பெறுநரின் பெயர்],

உங்கள் மதிப்பிற்குரிய நிறுவனத்தில் ஒரு முக்கிய கணக்கு பதவிக்கு விண்ணப்பிக்க நான் எழுதுகிறேன். சிறு கணக்குகளை நிர்வகிப்பதில் உறுதியான சாதனையுடன், எனது திறமைகள், அனுபவம் மற்றும் அர்ப்பணிப்பு ஆகியவற்றைப் பயன்படுத்தி உங்கள் நிறுவனத்தின் வளர்ச்சிக்கு குறிப்பிடத்தக்க பங்களிப்பை வழங்குவதில் எனக்கு நம்பிக்கை உள்ளது. உங்கள் மதிப்பாய்விற்கான எனது விண்ணப்பத்தை இணைக்கவும்.

எனது விண்ணப்பத்தை பரிசீலித்ததற்கு நன்றி. எனது தகுதிகளை மேலும் விவாதிக்க வாய்ப்பை எதிர்பார்க்கிறேன்.

உண்மையுள்ள,

[உங்கள் பெயர்]Major to Minor Account Application For Any Bank

Dear Sir/Madam,

I am writing to apply for a major to minor account conversion at your esteemed bank. As a responsible individual, I understand the importance of financial management and would like to have greater control over my finances.

Having reached the age of majority, I now seek to convert my existing major account to a minor account, which will allow me to make informed decisions regarding my savings and expenditures. I have attached all the necessary documents, including my identification proof and the relevant forms, as per your requirements.

I am confident that your bank’s excellent reputation for customer service and reliability will ensure a smooth transition. Thank you for considering my application, and I look forward to hearing from you soon.

Yours sincerely, [Your Name]

Major to Minor Account Application For SBI Bank

Dear Sir/Madam,

I am writing to request a major to minor account conversion at SBI Bank. As I have recently turned 18, I would like to switch my existing major account to a minor account to better manage my finances.

Enclosed with this letter are all the necessary documents, including my identification proof and the completed application form.

I am confident in SBI Bank’s reputation for excellent customer service and trustworthiness. I kindly request your prompt attention to this matter.

Thank you for your consideration.

Yours sincerely, [Your Name]

Post Office Minor to Major Account Application

[Your Name] [Your Address] [City, State, ZIP Code] [Date]Post Office Account Services [Post Office Address] [City, State, ZIP Code]

Subject: Application for Upgrading Post Office Minor Account to Major Account

Dear Sir/Madam,

I am writing to request the upgrade of my Post Office Minor Account to a Major Account. I have been a customer of your esteemed Post Office for several years, and I believe it is now appropriate to transition to a Major Account.

I have enclosed all the necessary documents, including my identification proof (copy of passport/driving license) and the completed application form. Additionally, I have obtained the consent of my legal guardian [if applicable] as per the requirements.

I kindly request you to process my application at your earliest convenience. Please feel free to contact me at [Your Contact Number] or [Your Email Address] for any further information or clarification.

Thank you for your prompt attention to this matter. I look forward to your positive response.

Yours faithfully,

[Your Name]Minor Account Creation Process

To create a minor account, follow these steps:

- Choose a suitable bank or financial institution that offers minor accounts.

- Gather the necessary documents, such as the minor’s birth certificate, social security number, and proof of address.

- Visit the bank in person or apply online through the institution’s website.

- Complete the account application form, providing the required information for both the minor and the parent or guardian.

- Submit the application along with the supporting documents.

- Review and sign any additional agreements or disclosures.

- Fund the account with an initial deposit if required.

- Receive the account details, including the account number and any associated cards or online banking credentials.

- Set up online banking or mobile app access if available.

- Educate the minor on responsible account management and financial literacy.

Major Account Creation Process

- Identify major accounts based on criteria such as revenue potential and strategic importance.

- Gather information about each major account, including their history, decision-makers, and challenges.

- Analyze account needs and align your products or services to address them.

- Develop a customized strategy for each major account, setting objectives and defining action steps.

- Build strong relationships with key stakeholders through regular communication and personalized support.

- Monitor account performance, track metrics, and make adjustments to optimize results.

- Expand account growth through upselling, cross-selling, and referrals.

- Retain major accounts through excellent service and contract renewals.

Documents Required for Opening Major Account

Major Account:

- Proof of identity (e.g., passport)

- Proof of address (e.g., utility bill)

- Social Security Number or Tax ID

- Employment/income verification

Minor Account:

- Minor’s birth certificate/passport

- Parent/legal guardian’s ID

- Social Security Number or Tax ID (if applicable)

- Proof of address (parent/legal guardian)

- Parent/legal guardian consent form.

FAQs on Minor to Major Account Application Letter

A minor to major account application letter is a written request submitted by an individual who wants to upgrade their existing bank account from a minor account (held by someone below the legal age of majority) to a major account (held by an adult).

The application letter should include the account holder’s name, account number, reason for the upgrade, proof of identity, and any necessary supporting documents required by the bank.

In most cases, a minor cannot upgrade their account without parental or guardian consent. The application letter should also include the consent of the parent or legal guardian.

Banks may charge certain fees for upgrading the account, such as administrative or account conversion fees. These fees should be clearly mentioned in the application letter.

Once the account is upgraded, the minor becomes the account’s sole owner and gains full control over it, subject to any applicable banking regulations.

Leave a Reply